Portfolio Optimization

Contents

Portfolio Optimization#

This Jupyter notebook demonstrates the formulation and solution of portfolio optimization problems.

Import libraries#

import matplotlib.pyplot as plt

import numpy as np

import random

# data wrangling libraries

import pandas_datareader.data as web

import pandas as pd

import datetime

Load Price Data#

Here we create several groups of possible trading symbols, and select one for study.

# Companies of the Dow Jones Industrial Average

djia = ['axp', 'aapl', 'amgn', 'ba', 'cat', 'crm', 'cvx', 'csco', 'dis', 'dow',

'gs', 'hd', 'hon', 'ibm', 'intc', 'jnj', 'jpm', 'ko', 'mcd', 'mmm', 'mrk',

'msft', 'nke', 'pg', 'trv', 'unh', 'vz', 'v', 'wba', 'wmt']

# Representative ETF's and ETN's from the energy sector

energy = ['uso', 'ung', 'tan', 'wndy', ]

# Standard indices

indices = ['^dji', '^gspc']

# pick one of these groups for study

symbols = djia[0:5]

#symbols = energy

print(symbols)

['axp', 'aapl', 'amgn', 'ba', 'cat']

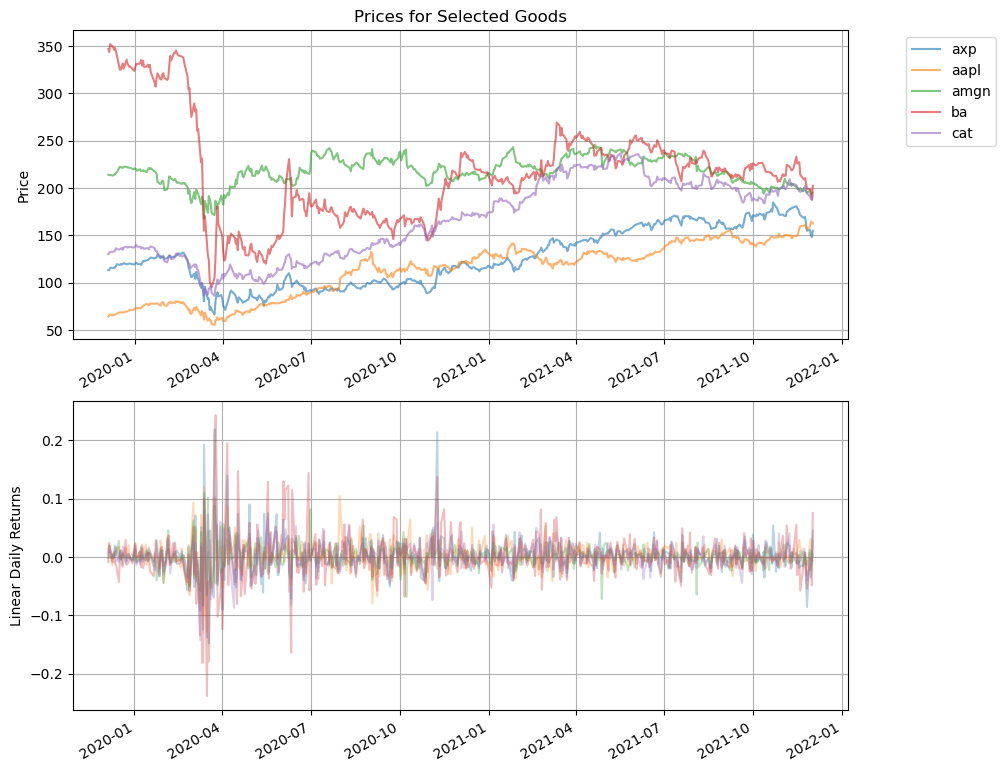

Price data is retrieved using the Pandas DataReader function. The first price data set consists of historical data that will be used to design investment portfolios. The second set will be used for simulation and evaluation of resulting portfolios. The use of ‘out-of-sample’ data for evaluation is standard practice in these types of applications.

t2 = datetime.datetime.now()

t1 = t2 - datetime.timedelta(365)

t0 = t1 - datetime.timedelta(2*365)

prices = pd.DataFrame()

prices_test = pd.DataFrame()

for symbol in symbols:

print(symbol, end='')

for _ in range(3):

try:

prices[symbol] = web.DataReader(symbol, 'yahoo', t0, t1)["Adj Close"]

prices_test[symbol] = web.DataReader(symbol, 'yahoo', t1, t2)["Adj Close"]

print(' ok.', end="")

break

except:

print(" fail. Try again.", end="")

print()

axp ok.

aapl ok.

amgn ok.

ba ok.

cat ok.

Plot Price and Returns Data#

prices.head()

| axp | aapl | amgn | ba | cat | |

|---|---|---|---|---|---|

| Date | |||||

| 2019-12-04 | 113.070 | 64.105 | 214.000 | 346.777 | 130.179 |

| 2019-12-05 | 113.396 | 65.046 | 213.570 | 343.635 | 131.043 |

| 2019-12-06 | 115.629 | 66.302 | 213.900 | 351.996 | 132.594 |

| 2019-12-09 | 115.486 | 65.374 | 213.031 | 349.133 | 132.697 |

| 2019-12-10 | 115.907 | 65.756 | 213.964 | 345.842 | 132.734 |

fig, ax = plt.subplots(2, 1, figsize=(10, 10))

prices.plot(ax=ax[0], title='Prices for Selected Goods', xlabel="", ylabel="Price", grid=True, alpha=0.6)

ax[0].legend(loc='upper right', bbox_to_anchor=(1.2, 1.0))

returns = prices.diff()/prices.shift(1)

returns.plot(ax=ax[1], ylabel='Linear Daily Returns', xlabel="", grid=True, alpha=0.3, legend=False)

<AxesSubplot:ylabel='Linear Daily Returns'>

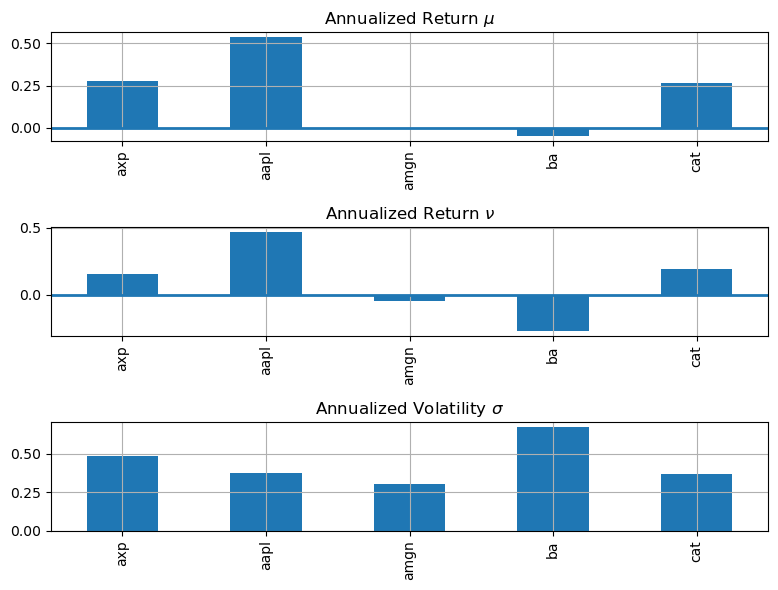

Linear and Log Returns#

returns = prices.diff()/prices.shift(1)

mu = (prices.diff()/prices.shift(1)).mean()

nu = np.log(prices).diff().mean()

sigma = np.log(prices).diff().std()

fig, ax = plt.subplots(3, 1, figsize=(8, 6))

(252*mu).plot(ax=ax[0], kind='bar', title='Annualized Return $\\mu$', grid=True)

ax[0].axhline(lw=2)

(252*nu).plot(ax=ax[1], kind='bar', title='Annualized Return $\\nu$', grid=True)

ax[1].axhline(lw=2)

(np.sqrt(252)*sigma).plot(ax=ax[2], kind='bar', title='Annualized Volatility $\\sigma$', grid=True)

fig.tight_layout()

print( "Annualized Returns and Standard Deviation\n")

print( "Symbol mu nu mu-s^2/2 sigma")

for s in returns.columns.values.tolist():

print(f"{s:5s}", end='')

print(f" {252.0*mu[s]:9.3f}", end='')

print(f" {252.0*nu[s]:9.3f}", end='')

print(f" {252.0*(mu[s] - 0.5*sigma[s]**2):9.3f}", end='')

print(f" {np.sqrt(252.0)*sigma[s]:9.3f}")

Annualized Returns and Standard Deviation

Symbol mu nu mu-s^2/2 sigma

axp 0.276 0.157 0.158 0.486

aapl 0.536 0.467 0.467 0.372

amgn -0.001 -0.047 -0.047 0.303

ba -0.047 -0.270 -0.271 0.669

cat 0.262 0.195 0.195 0.366

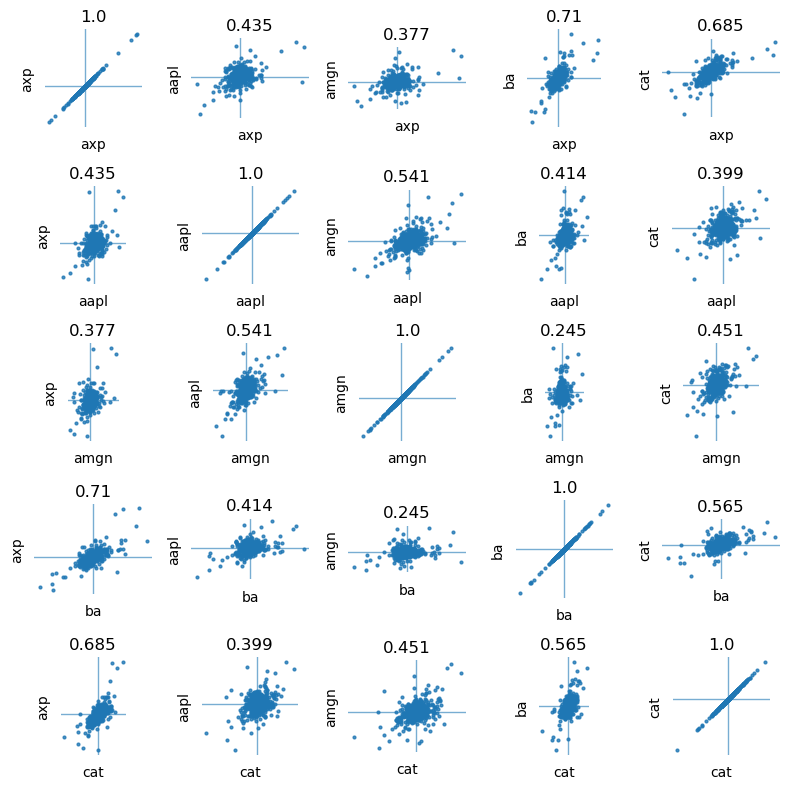

Covariance and Correlation Matrices#

The covariance matrix is easily computed using the pandas .cov and .corr() functions.

cov = returns.cov()

rho = returns.corr()

pd.options.display.float_format = ' {:,.3f}'.format

print("\nAnnualized Covariance Matrix\n", 252*cov)

print("\nCorrelation Coefficients\n", rho)

Annualized Covariance Matrix

axp aapl amgn ba cat

axp 0.244 0.080 0.057 0.234 0.123

aapl 0.080 0.138 0.061 0.103 0.054

amgn 0.057 0.061 0.093 0.050 0.050

ba 0.234 0.103 0.050 0.446 0.137

cat 0.123 0.054 0.050 0.137 0.133

Correlation Coefficients

axp aapl amgn ba cat

axp 1.000 0.435 0.377 0.710 0.685

aapl 0.435 1.000 0.541 0.414 0.399

amgn 0.377 0.541 1.000 0.245 0.451

ba 0.710 0.414 0.245 1.000 0.565

cat 0.685 0.399 0.451 0.565 1.000

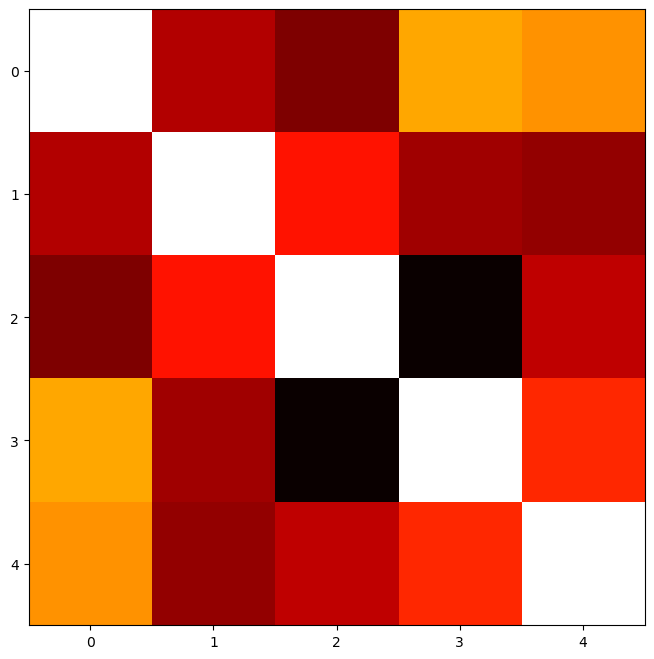

Visualizing the correlation coefficients#

syms = prices.columns

N = len(syms)

fig, ax = plt.subplots(N, N, figsize=(8, 8))

for i in range(0, N):

for j in range(0, N):

ax[i, j].plot(returns[syms[i]], returns[syms[j]], '.', ms=4, alpha=0.8)

ax[i, j].axhline(0, lw=1, alpha=0.6)

ax[i, j].axvline(0, lw=1, alpha=0.6)

ax[i, j].axes.spines['top'].set_visible(False)

ax[i, j].axes.spines['right'].set_visible(False)

ax[i, j].axes.spines['bottom'].set_visible(False)

ax[i, j].axes.spines['left'].set_visible(False)

ax[i, j].axes.get_xaxis().set_ticks([])

ax[i, j].axes.get_yaxis().set_ticks([])

ax[i, j].set_xlabel(syms[i])

ax[i, j].set_ylabel(syms[j])

ax[i, j].set_aspect(1)

ax[i, j].set_title(str(round(rho[syms[i]][syms[j]], 3)))

plt.tight_layout()

fig, ax = plt.subplots(1, 1, figsize=(8, 8))

ax.imshow(rho, cmap='hot', interpolation='nearest')

<matplotlib.image.AxesImage at 0x7fe96ab3b3d0>

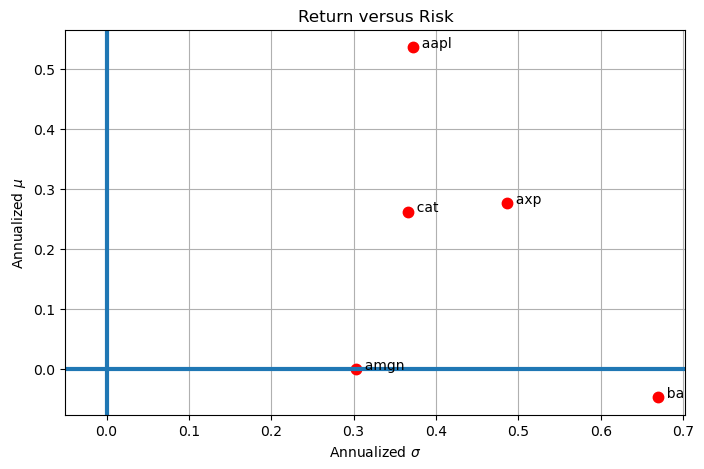

Return versus Volatility#

plt.figure(figsize=(8, 5))

for s in returns.columns.values.tolist():

plt.plot(np.sqrt(252.0)*sigma[s], 252*mu[s], 'r.', ms=15)

plt.text(np.sqrt(252.0)*sigma[s], 252*mu[s], f" {s:5<s}")

plt.axhline(0, lw=3)

plt.axvline(0, lw=3)

plt.xlim(-0.05, plt.xlim()[1])

plt.title('Return versus Risk')

plt.xlabel('Annualized $\sigma$')

plt.ylabel('Annualized $\mu$')

plt.grid(True)

Creating Portfolios#

A portfolio is created by allocating current wealth among a collection of assets. Let \(w_n\) be the fraction of wealth allocated to the \(n^{th}\) asset from a set of \(N\) assets. Then

It may be possible to borrow assets, in which case the corresponding \(w_n\) is negative. A long only portfolio is one such that all of weights \(w_n\) are greater than or equal to zero.

Mean Return and Variance of a Portfolio#

Denoting the total value of the portfolio as V, the value invested in asset \(n\) is \(w_nV\). At a price \(S_n\), the number of units of the asset is \(\frac{w_nV}{S_n}\) for a total value

at the start of the investment period. The value of the investment at the end of the period, \(V'\), is given by

Taking differences we find

which, after division, yields the return on the portfolio

Taking expectations, the mean return of the portfolio

Variance of portfolio return

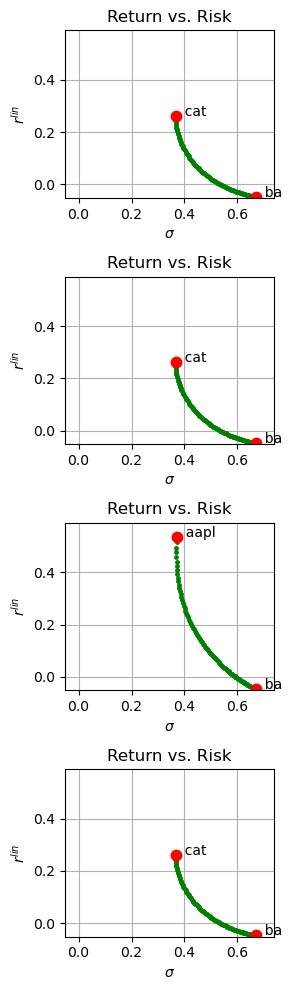

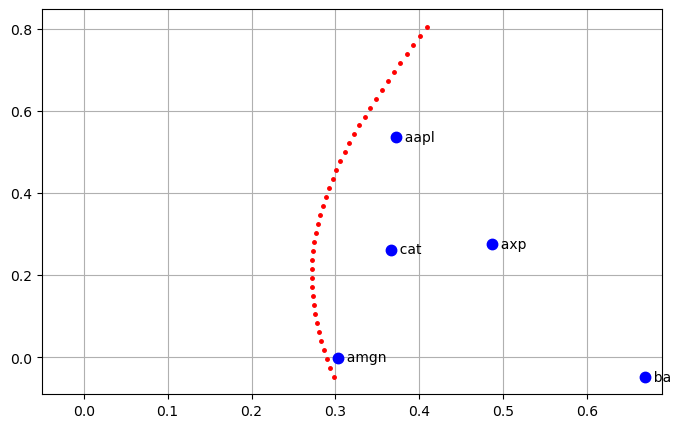

Examples of Portfolios with Two Assets#

N_examples = 4

fig, ax = plt.subplots(N_examples, 1, figsize=(3, 10))

for i in range(0, N_examples):

a, b = random.sample(prices.columns.values.tolist(), 2)

for w in np.linspace(0.0, 1.0, 100):

V = w*prices[a] + (1-w)*prices[b]

rV = (V.diff()/V.shift(1))

ax[i].plot(np.sqrt(252.0)*rV.std(), 252*rV.mean(),'g.', ms=5)

for s in (a, b):

ax[i].plot(np.sqrt(252.0)*sigma[s], 252*mu[s], 'r.', ms=15)

ax[i].text(np.sqrt(252.0)*sigma[s], 252*mu[s], " {0:5<s}".format(s))

ax[i].set_xlim(-0.05, 1.1*np.sqrt(252.0)*sigma.max())

ax[i].set_ylim(1.1*252.0*mu.min(), 1.1*252.0*mu.max())

ax[i].set_title('Return vs. Risk')

ax[i].set_xlabel('$\sigma$')

ax[i].set_ylabel('$r^{lin}$')

ax[i].grid()

fig.tight_layout()

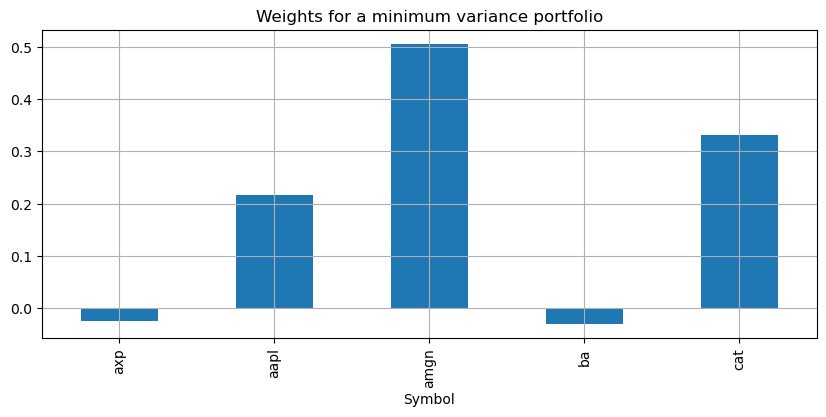

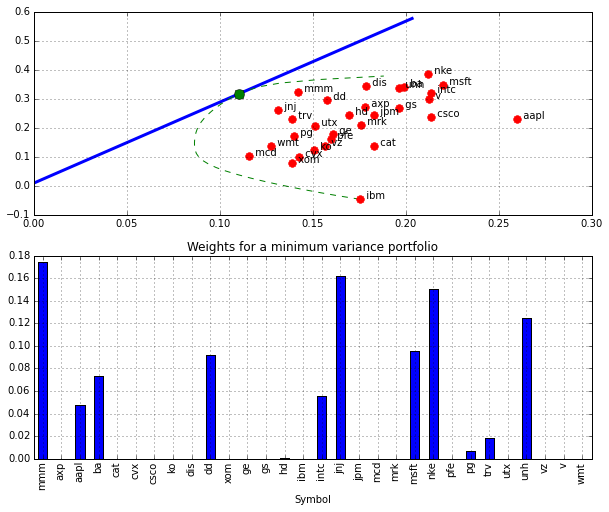

Minimum Risk Portfolio#

The minimum variance portfolio is found as a solution to $\(\min_{w_1, w_2, \ldots, w_N} \sum_{m=1}^N\sum_{n=1}^N w_m w_n\sigma_{mn}\)\( subject to \)\(\sum_{n=1}^N w_n = 1\)$

Pyomo Model and Solution#

import pyomo.environ as pyo

# pyomo model

m = pyo.ConcreteModel()

# data

m.STOCKS = pyo.Set(initialize=returns.columns)

m.w = pyo.Var(m.STOCKS)

@m.Expression()

def portfolio_return(m):

return sum(m.w[i] * mu[i] for i in m.STOCKS)

@m.Expression()

def portfolio_variance(m):

return sum(m.w[i] * cov.loc[i, j] * m.w[j] for i in m.STOCKS for j in m.STOCKS)

@m.Objective(sense=pyo.minimize)

def minimum_variance(m):

return m.portfolio_variance

@m.Constraint()

def weights(m):

return sum(m.w[i] for i in m.STOCKS) == 1

# solve

pyo. SolverFactory('ipopt').solve(m)

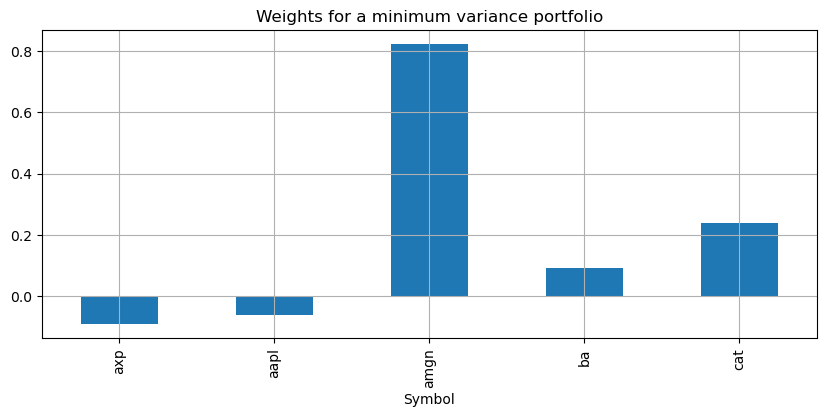

# display solutions

w = pd.Series([m.w[i]() for i in m.STOCKS], m.STOCKS)

w.plot(kind='bar', figsize=(10, 4))

plt.xlabel('Symbol')

plt.title('Weights for a minimum variance portfolio')

plt.grid()

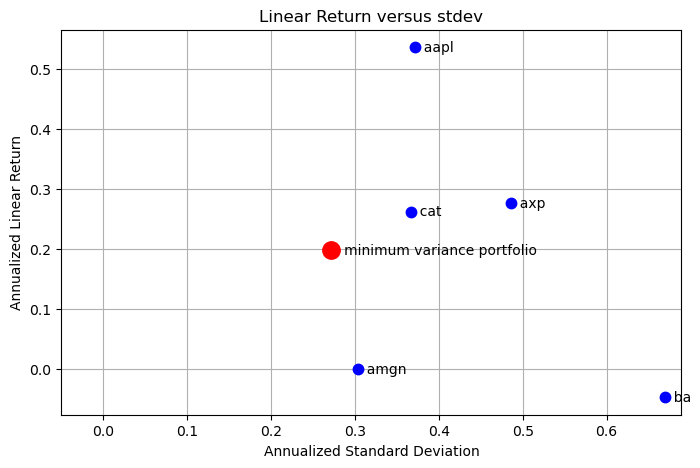

plt.figure(figsize=(8, 5))

for s in m.STOCKS:

plt.plot(np.sqrt(252.0)*sigma[s], 252*mu[s], 'b.', ms=15)

plt.text(np.sqrt(252.0)*sigma[s], 252*mu[s], " {0:5<s}".format(s), va="center")

plt.plot(np.sqrt(252.0)*np.sqrt(m.portfolio_variance()), 252*m.portfolio_return(),

'r.', ms=25)

plt.text(np.sqrt(252.0)*np.sqrt(m.portfolio_variance()), 252*m.portfolio_return(),

f" minimum variance portfolio", va="center")

plt.xlim(-0.05, plt.xlim()[1])

plt.title('Linear Return versus stdev')

plt.xlabel('Annualized Standard Deviation')

plt.ylabel('Annualized Linear Return')

plt.grid(True)

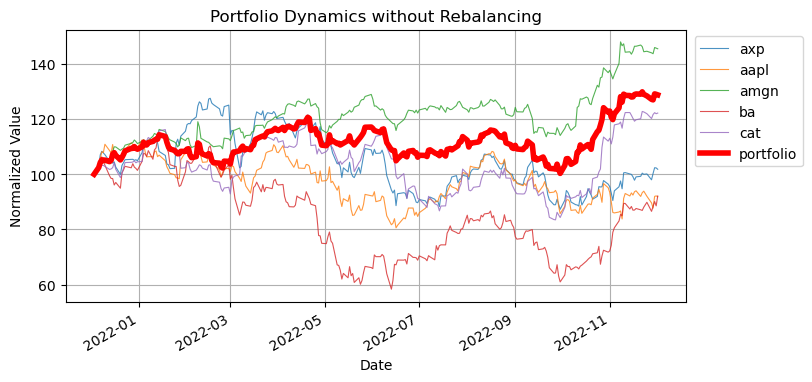

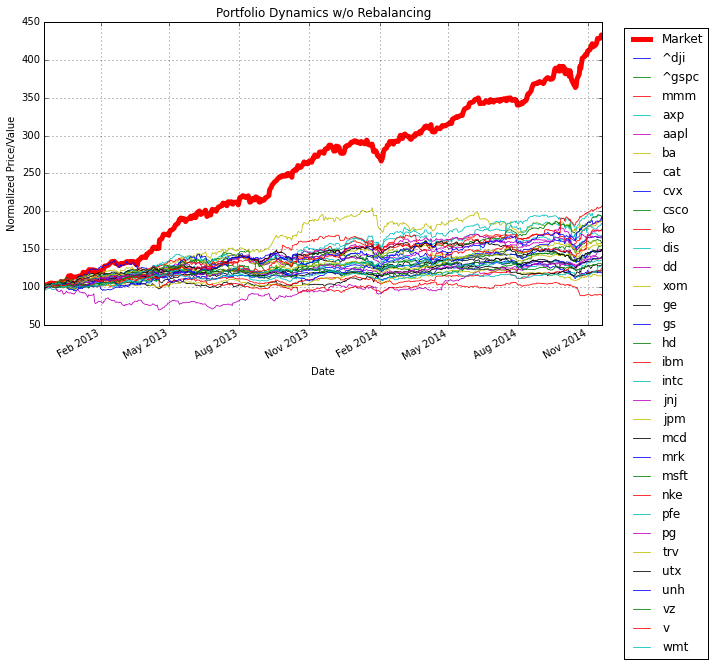

Out-of-Sample Testing#

Let’s test the performance of the minimum variance portfolio using out-of-sample price data.

# simulate portfolio of 100 units of currency

V = pd.Series(0, index=prices_test.index)

for s in m.STOCKS:

V += (100.0*float(m.w[s]())/prices_test[s][0])*prices_test[s]

# plot reference stocks

for s in m.STOCKS:

pd.Series(100.0*prices_test[s]/prices_test[s][0]).plot(lw=0.8, alpha=0.8)

V.plot(lw=4, figsize=(8, 4) ,color='red', label="portfolio",

title="Portfolio Dynamics without Rebalancing", ylabel="Normalized Value", grid=True)

plt.legend(loc='upper right', bbox_to_anchor=(1.2, 1.0))

<matplotlib.legend.Legend at 0x7fe96c462f40>

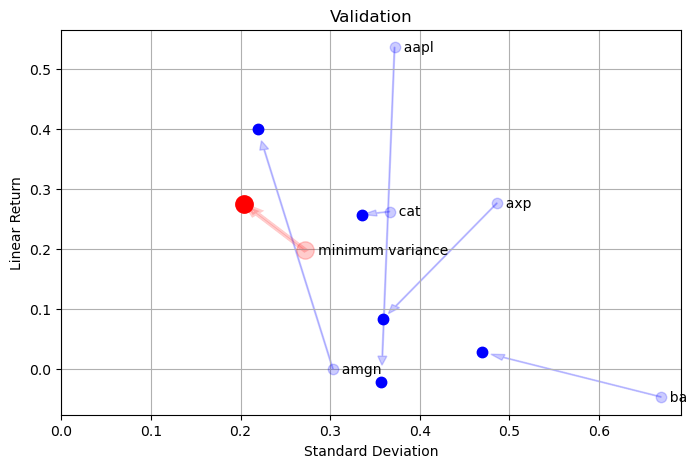

plt.figure(figsize=(8, 5))

returns_test = prices_test.diff()/prices_test.shift(1)

mu_test = returns_test.mean()

sigma_test = returns_test.std()

# plot stock components

for s in returns.columns:

x = np.sqrt(252.0)*sigma[s]

dx = np.sqrt(252.0)*(sigma_test[s] - sigma[s])

y = 252.0*mu[s]

dy = 252.0*(mu_test[s] - mu[s])

plt.plot(x, y, 'b.', ms=15, alpha=0.2)

plt.text(x, y, f" {s:5<s}", va="center")

plt.arrow(x, y, 0.95*dx, 0.95*dy, length_includes_head=True, head_width=0.01, color='b', alpha=0.2)

plt.plot(x + dx, y + dy, 'b.', ms=15)

plt.xlim(0.0,plt.xlim()[1])

plt.title('Validation')

plt.xlabel('Standard Deviation')

plt.ylabel('Linear Return')

plt.grid(True)

x = np.sqrt(252.0)*np.sqrt(m.portfolio_variance())

y = 252*m.portfolio_return()

plt.plot(x, y, 'r.', ms=25, alpha=0.2)

plt.text(x, y, f" minimum variance", va="center")

ReturnsV = (V.diff()/V.shift(1))

rlinMinVar = ReturnsV.mean()

stdevMinVar = ReturnsV.std()

dx = np.sqrt(252.0)*stdevMinVar - x

dy = 252.0*rlinMinVar - y

plt.plot(x + dx, y + dy, 'r.', ms=25)

plt.arrow(x, y, 0.95*dx, 0.95*dy, length_includes_head=True, head_width=0.01, color='r', lw=3, alpha=0.2)

<matplotlib.patches.FancyArrow at 0x7fe96c929b20>

Markowitz Portfolio#

The minimum variance portfolio does a good job of handling volatility, but at the expense of relatively low return. The Markowitz portfolio adds an additional constraint to specify mean portfolio return. $\(\min_{w_1, w_2, \ldots, w_N} \sum_{m=1}^N\sum_{n=1}^N w_m w_n\sigma_{mn}\)\( subject to \)\(\sum_{n=1}^N w_n = 1\)\( and \)\(\sum_{n=1}^N w_n \bar{r}^{lin}_n = \bar{r}^{lin}_p\)\( By programming the solution of the optimization problem as a function of \)\bar{r}_p$, it is possible to create a risk-return tradeoff curve.

import pyomo.environ as pyo

def markowitz_model(returns, cov, rp=None):

m = pyo.ConcreteModel()

m.rp = pyo.Param(initialize=rp, mutable=True)

m.STOCKS = pyo.Set(initialize=returns.columns)

m.w = pyo.Var(m.STOCKS)

@m.Expression()

def portfolio_return(m):

return sum(m.w[i] * mu[i] for i in m.STOCKS)

@m.Expression()

def portfolio_variance(m):

return sum(m.w[i] * cov.loc[i, j] * m.w[j] for i in m.STOCKS for j in m.STOCKS)

@m.Objective(sense=pyo.minimize)

def minimum_variance(m):

return m.portfolio_variance

@m.Constraint()

def weights(m):

return sum(m.w[i] for i in m.STOCKS) == 1

@m.Constraint()

def ma(m):

if m.rp is not None:

return m.portfolio_return == m.rp

else:

return pyo.Constraint.Skip

# solve

pyo. SolverFactory('ipopt').solve(m)

return(m)

m = markowitz_model(returns, cov, 0.0/252)

w = pd.Series([m.w[i]() for i in m.STOCKS], m.STOCKS)

w.plot(kind='bar', figsize=(10, 4))

plt.xlabel('Symbol')

plt.title('Weights for a minimum variance portfolio')

plt.grid()

fig, ax = plt.subplots(1, 1, figsize=(8, 5))

for s in m.STOCKS:

ax.plot(np.sqrt(252.0)*sigma[s], 252*mu[s], 'b.', ms=15)

ax.text(np.sqrt(252.0)*sigma[s], 252*mu[s], " {0:5<s}".format(s), va="center")

m = markowitz_model(returns, cov, 0/252)

solver = pyo.SolverFactory('ipopt')

# scan solution as function of portfolio return

for rp in np.linspace(min(0, mu.min()), 1.5*mu.max(), 40):

m.rp.value = rp

solver.solve(m)

x = np.sqrt(252 * m.portfolio_variance())

y = 252 * m.portfolio_return()

ax.plot(x, y, 'r.', ms=5)

ax.set_xlim(-0.05, )

ax.grid(True)

Markowitz Portfolio without Shorting#

At this point there are no constraints on portfolio weights \(w_1, w_2, \ldots, w_N\) other than they must sum to one. It is possible for the solution to the minimum variance or Markowitz portfolio problems to include negative weights, or weights greater than one. A negative weight corresponds to short selling an asset within the portfolio. A weight greater than one implies that short selling has taken place and the proceeds used to buy a stake in another asset that is greater in value than the portfolio. These are aggressive investment strategies.

A common constraint on operators or investors will accept short selling as a business strategy.

The minimum variance portfolio does a good job of handling volatility, but at the expense of relatively low return. The Markowitz portfolio adds an additional constraint to specify mean portfolio return. $\(\min_{w_1, w_2, \ldots, w_N} \sum_{m=1}^N\sum_{n=1}^N w_m w_n\sigma_{mn}\)\( subject to \)\(\sum_{n=1}^N w_n = 1\)\( and \)\(\sum_{n=1}^N w_n \bar{r}^{lin}_n = \bar{r}^{lin}_p\)\( By programming the solution of the optimization problem as a function of \)\bar{r}_p$, it is possible to create a risk-return tradeoff curve.

Risk-Free Asset#

The minimum variance portfolio does a good job of handling volatility, but at the expense of relatively low return. The Markowitz portfolio adds an additional constraint to specify mean portfolio return. $\(\min_{w_1, w_2, \ldots, w_N} \sum_{m=1}^N\sum_{n=1}^N w_m w_n\sigma_{mn}\)\( subject to \)\(\sum_{n=1}^N w_n = 1 - w_f\)\( and \)\(\sum_{n=1}^N w_n \bar{r}^{lin}_n + w_f r_f = \bar{r}^{lin}_p\)\( By programming the solution of the optimization problem as a function of \)\bar{r}_p$, it is possible to create a risk-return tradeoff curve.

# cvxpy problem description

m = ConcreteModel()

m.w = Var(range(0,N), domain = Reals)

wf

w = cvx.Variable(N)

wf = cvx.Variable(1)

r = cvx.Parameter()

rf = 0.01/252.0

risk = cvx.quad_form(w, np.array(sigma))

prob = cvx.Problem(cvx.Minimize(risk),

[cvx.sum_entries(w) == 1 - wf,

np.array(rlin).T*w + wf*rf == r,

w >= 0])

# lists to store results of parameter scans

r_data_rf = []

stdev_data_rf = []

w_data_rf = []

# scan solution as function of portfolio return

for rp in np.linspace(np.min(rf,rlin.min()),1.5*rlin.max(),100):

r.value = rp

s = prob.solve()

if prob.status == "optimal":

r_data_rf.append(rp)

stdev_data_rf.append(np.sqrt(prob.solve()))

w_data_rf.append([u[0,0] for u in w.value])

plt.figure(figsize=(10,8))

plt.subplot(211)

plt.plot(np.sqrt(252.0)*np.array(stdev_data_rf), 252.0*np.array(r_data_rf),lw=3)

plt.plot(np.sqrt(252.0)*np.array(stdev_data), 252.0*np.array(r_data),'g--')

for s in syms:

plt.plot(np.sqrt(252.0)*stdev[s],252.0*rlin[s],'r.',ms=15)

plt.text(np.sqrt(252.0)*stdev[s],252.0*rlin[s]," {0:5<s}".format(s))

# find max Sharpe ratio

k = np.argmax(np.divide(np.array(r_data)-rf,np.array(stdev_data)))

smax = stdev_data[k]

rmax = r_data[k]

plt.plot(np.sqrt(252.0)*smax,252.0*rmax,'o',ms=10)

print 252.0*rmax

print 252.0*rf

print np.sqrt(252.0)*smax

plt.xlim(0.0,plt.xlim()[1])

plt.grid()

plt.subplot(212)

wval = pd.Series(w_data[k],syms)

wval.plot(kind='bar')

plt.xlabel('Symbol')

plt.title('Weights for a minimum variance portfolio')

plt.grid()

0.319026600441

0.01

0.110681042214

N = len(Prices.columns.values.tolist())

# create price history of the portfolio

V = pd.Series(0,index=Prices.index,name='Market')

for s in Prices.columns.values.tolist():

V += (100.0*float(wval[s])/Prices[s][0])*Prices[s]

V.plot(lw=5,figsize=(10,6),color='red')

# plot components

plt.hold(True)

for s in Prices.columns.values.tolist():

S = pd.Series(100.0*Prices[s]/Prices[s][0])

S.plot(lw=0.8)

plt.legend(loc='upper right',bbox_to_anchor=(1.2, 1.0))

plt.title('Portfolio Dynamics w/o Rebalancing')

plt.ylabel('Normalized Price/Value')

plt.grid()

P['Market'] = V

Sigma = P.cov()

Sigma.ix[:,'Market']/Sigma.ix['Market','Market']

^dji 12.528858

^gspc 1.934181

mmm 0.197222

axp 0.120742

aapl 0.133096

ba 0.208771

cat 0.072742

cvx 0.051164

csco 0.016654

ko 0.016795

dis 0.136692

dd 0.086136

xom 0.053090

ge 0.020513

gs 0.154648

hd 0.086056

ibm -0.047416

intc 0.046451

jnj 0.122271

jpm 0.054673

mcd 0.023521

mrk 0.067638

msft 0.068685

nke 0.121157

pfe 0.016580

pg 0.048426

trv 0.075682

utx 0.104676

unh 0.123136

vz 0.022144

v 0.065840

wmt 0.029284

Market 1.000000

Name: Market, dtype: float64

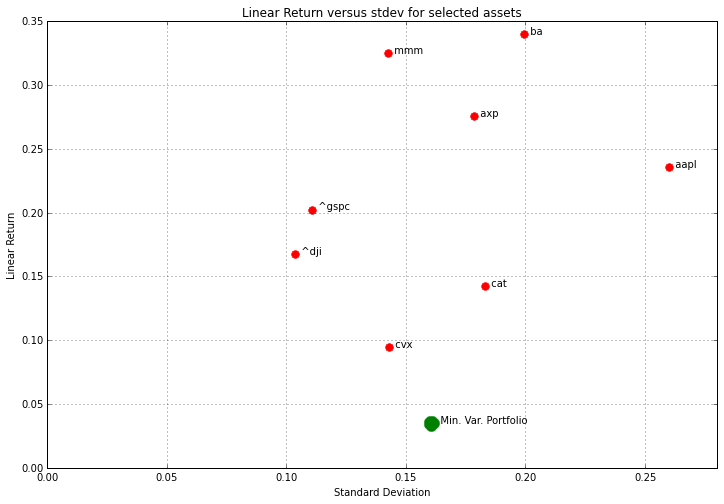

Maximum Log Return (to be developed).#

import cvxpy as cvx

N = len(syms)

w = cvx.Variable(N)

risk = cvx.quad_form(w, np.array(sigma))

prob = cvx.Problem(cvx.Maximize(np.array(rlin).T*w-0.5*risk),

[cvx.sum_entries(w) == 1,

risk <= 0.0005/np.sqrt(252.0),

w>=0])

prob.solve()

print prob.status

plt.figure(figsize=(12,8))

for s in Returns.columns.values.tolist():

plt.plot(np.sqrt(252.0)*stdev[s],252*rlin[s],'r.',ms=15)

plt.text(np.sqrt(252.0)*stdev[s],252*rlin[s]," {0:5<s}".format(s))

plt.xlim(0.0,plt.xlim()[1])

plt.title('Linear Return versus stdev for selected assets')

plt.xlabel('Standard Deviation')

plt.ylabel('Linear Return')

plt.grid()

plt.hold(True)

plt.plot(np.sqrt(252.0)*stdevMinVar,252.0*rlinMinVar,'g.',ms=30)

plt.text(np.sqrt(252.0)*stdevMinVar,252.0*rlinMinVar,' Min. Var. Portfolio')

wval = np.array(w.value)[:,0].T

rlog = np.dot(np.array(rlin).T,wval)

stdevlog = np.sqrt(np.dot(np.dot(wval,np.array(sigma)),wval))

plt.plot(np.sqrt(252.0)*stdevlog,252.0*rlog,'g.',ms=30)

plt.text(np.sqrt(252.0)*stdevlog,252.0*rlog,' Max. Return Portfolio')

infeasible

---------------------------------------------------------------------------

IndexError Traceback (most recent call last)

<ipython-input-353-221d4f60194f> in <module>()

28 plt.text(np.sqrt(252.0)*stdevMinVar,252.0*rlinMinVar,' Min. Var. Portfolio')

29

---> 30 wval = np.array(w.value)[:,0].T

31 rlog = np.dot(np.array(rlin).T,wval)

32 stdevlog = np.sqrt(np.dot(np.dot(wval,np.array(sigma)),wval))

IndexError: too many indices for array

Exercises#

Modify the minimum variance portfolio to be ‘long-only’, and add a diversification constraints that no more than 20% of the portfolio can be invested in any single asset. How much does this change the annualized return? the annualized standard deviation?

Modify the Markowitz portfolio to allow long-only positions and a diversification constraint that no more than 20% of the portfolio can be invested in any single asset. What conclusion to you draw?