Portfolio Optimization

Contents

Portfolio Optimization#

This IPython notebook demonstrates portfolio optimization using the Mean Absolute Deviation (MAD) criterion. A portion of these notes is adapted from GLPK Wikibook tutorial on the subject written by me.

J.C. Kantor (Kantor.1@nd.edu)

The latest version of this IPython notebook is available at http://github.com/jckantor/CBE20255 for noncommercial use under terms of the Creative Commons Attribution Noncommericial ShareAlike License.

Investment Objectives#

Maximize returns

Reduce Risk through diversification

Why Diversify?#

Investment portfolios are collections of investments that are managed for overall investment return. Compared to investing all of your capital into a single asset, maintaining a portfolio of investments allows you to manage risk through diversification.

Reduce Risk through Law of Large Numbers#

Suppose there are a set of independent investment opportunities that will pay back between 0 and 300% of your original investment, and that all outcomes in that range are equally likely. You have $100,000 to invest. Should you put it all in one opportunity? Or should you spread it around?

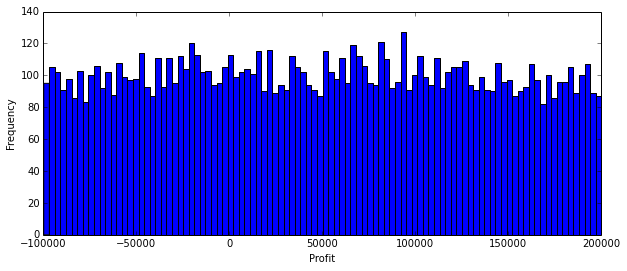

Here we simulate the outcomes of 1000 trials where we place all the money into a sigle investment of $100,000.

W0 = 100000.00

Ntrials = 10000

Profit = list()

for n in range(0,Ntrials):

W1 = W0*random.uniform(0,3.00)

Profit.append(W1 - W0)

figure(figsize=(10,4))

hist(Profit,bins=100);

xlabel('Profit')

ylabel('Frequency')

print "Average Profit = ${:.0f}".format(mean(Profit))

Average Profit = $49126

As you would expect, about 1/3 of the time there is a loss, and about 2/3 of the time there is a profit. Is this an acceptable investment outcome?

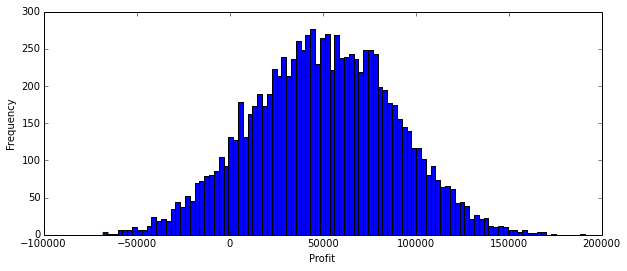

Let’s see what happens if the $100,000 investment over a small number of equal sized investments.

W0 = 100000.00

Ntrials = 10000

Ninvestments = 5

Profit = list()

for n in range(0,Ntrials):

W1 = sum([(W0/Ninvestments)*random.uniform(0,3.00) for _ in range(0,Ninvestments)])

Profit.append(W1-W0)

figure(figsize=(10,4))

hist(Profit,bins=100);

xlim(-W0,2*W0)

xlabel('Profit')

ylabel('Frequency')

print "Average Profit = ${:.0f}".format(mean(Profit))

Average Profit = $50177

Even a modest degree of diversification reduces downside risk.

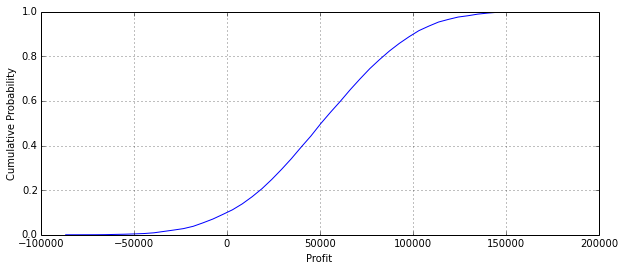

from statsmodels.distributions import ECDF

ecdf = ECDF(Profit)

x = linspace(min(Profit),max(Profit))

figure(figsize=(10,4))

plot(x,ecdf(x))

xlabel('Profit')

ylabel('Cumulative Probability')

grid();

Select a Portfolio from a Set of Candidate Portfolios#

djia = ['AXP','BA','CAT','CSCO','CVX','DD','DIS','GE', \

'GS','HD','IBM','INTC','JNJ','JPM','KO','MCD', \

'MMM','MRK','MSFT','NKE','PFE','PG','T','TRV', \

'UNH','UTX','V','VZ','WMT','XOM']

small_portfolio = ['F','AAPL','XOM','PG','KO']

portfolio = small_portfolio

portfolio = djia

Download Historical Data#

import pandas as pd

import datetime

import pandas.io.data

end = datetime.datetime.today().date()

start = end - datetime.timedelta(3*365)

adjclose = pd.DataFrame()

for s in portfolio:

data = pd.io.data.DataReader(s,"yahoo",start,end)

print "{:5s} {:d}".format(s,len(data))

adjclose[s] = data['Adj Close']

adjclose.plot(logy=True, legend=False, figsize=(10,6))

ylabel('Adjusted Close')

title('Adjusted Close for All Portfolio Assets')

AXP 754

BA 754

CAT 754

CSCO 754

CVX 754

DD 754

DIS 754

GE 754

GS 754

HD 754

IBM 754

INTC 754

JNJ 754

JPM 754

KO 754

MCD 754

MMM 754

MRK 754

MSFT 754

NKE 754

PFE 754

PG 754

T 754

TRV 754

UNH 754

UTX 754

V 754

VZ 754

WMT 754

XOM 754

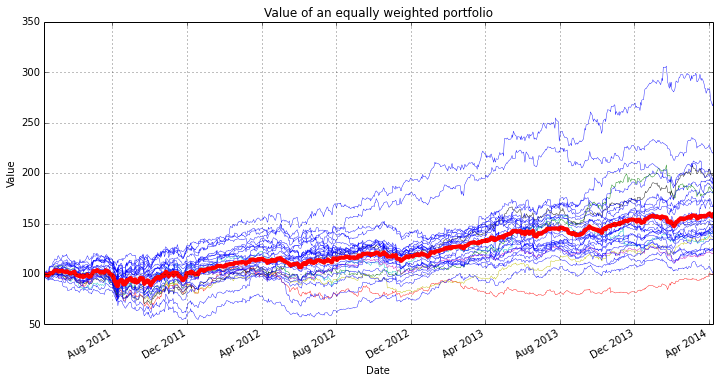

Equally Weighted Portfolio#

P_equal = pd.Series(0,index = adjclose.index)

for s in portfolio:

P_equal += 100.0*adjclose[s]/adjclose[s][0]/len(portfolio)

figure(figsize=(12,6))

for s in portfolio:

(100.0*adjclose[s]/adjclose[s][0]).plot(lw=0.4)

P_equal.plot(color='r',lw=4)

ylabel('Value');

title('Value of an equally weighted portfolio');

Compute Component Returns#

Arithmetic returns are required because subsequent calculations will be combining returns across components of a portfolio.

#returns = adjclose.diff()[1:]/adjclose[1:]

returns = log(adjclose/adjclose.shift(+1))

rmean = returns.mean()

mad = abs(returns-returns.mean()).mean()

# plug NaN holes due to missing data

for s in returns.columns:

for t in returns.index:

if isnan(returns[s][t]):

returns[s][t] = rmean[s]

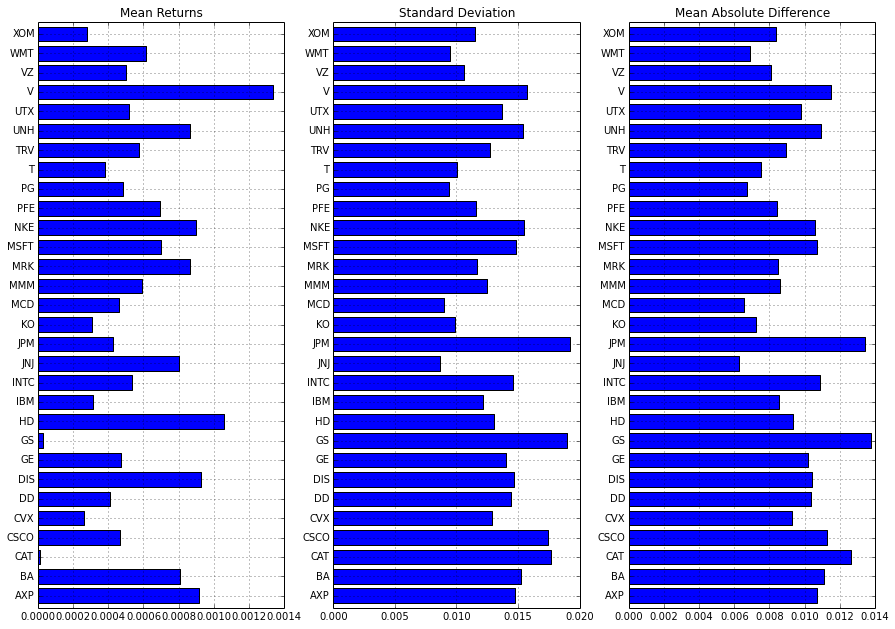

figure(figsize = (15,0.35*len(returns.columns)))

subplot(1,3,1)

returns.mean().plot(kind='barh')

title('Mean Returns');

subplot(1,3,2)

returns.std().plot(kind='barh')

title('Standard Deviation');

subplot(1,3,3)

abs(returns-returns.mean()).mean().plot(kind='barh')

title('Mean Absolute Difference');

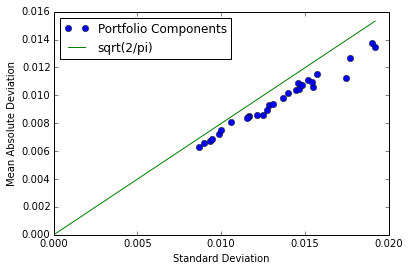

plot(returns.std(),abs(returns-returns.mean()).mean(),'o')

xlabel('Standard Deviation')

ylabel('Mean Absolute Deviation')

plot([0,returns.std().max()],[0,sqrt(2.0/pi)*returns.std().max()])

legend(['Portfolio Components','sqrt(2/pi)'],loc='best');

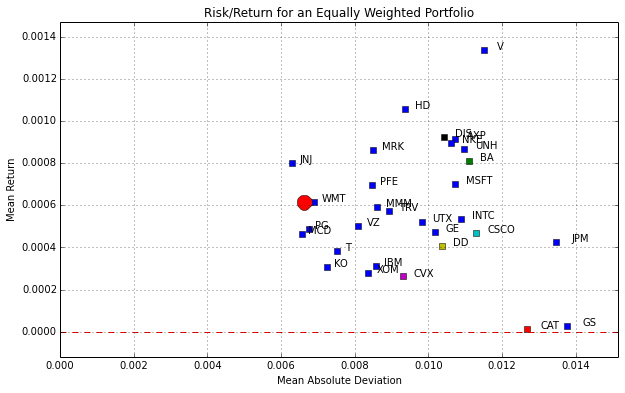

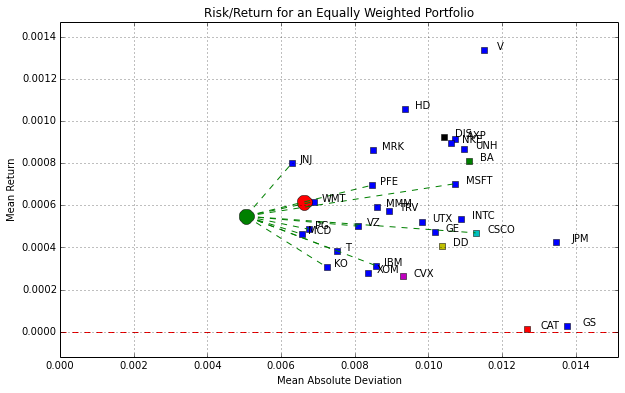

figure(figsize=(10,6))

for s in portfolio:

plot(mad[s],rmean[s],'s')

text(mad[s]*1.03,rmean[s],s)

axis([0, 1.1*max(mad), min([0,min(rmean)-.1*(max(rmean)-min(rmean))]), 1.1*max(rmean)])

ax = axis()

plot([ax[0],ax[1]],[0,0],'r--');

#R_equal = P_equal.diff()[1:]/P_equal[1:]

R_equal = log(P_equal/P_equal.shift(+1))

M_equal = abs(R_equal-R_equal.mean()).mean()

plot(M_equal,R_equal.mean(),'ro',ms=15)

title('Risk/Return for an Equally Weighted Portfolio')

xlabel('Mean Absolute Deviation')

ylabel('Mean Return')

grid();

MAD Porfolio#

The linear program is formulated and solved using the pulp package.

!pip install pulp

Requirement already satisfied (use --upgrade to upgrade): pulp in /Users/jeff/anaconda/lib/python2.7/site-packages

Requirement already satisfied (use --upgrade to upgrade): pyparsing<=1.9.9 in /Users/jeff/anaconda/lib/python2.7/site-packages (from pulp)

Cleaning up...

The decision variables will be indexed by date/time. The pandas dataframes containing the returns data are indexed by timestamps that include characters that cannot be used by the GLPK solver. Therefore we create a dictionary to translate the pandas timestamps to strings that can be read as members of a GLPK set. The strings denote seconds in the current epoch as defined by python.

t = {tstamp:"{:%s}".format(tstamp) for tstamp in returns.index}

import pulp

# mean absolute deviation for the portfolio

m = pulp.LpVariable('m', lowBound = 0)

# dictionary of portfolio weights

w = pulp.LpVariable.dicts('w', portfolio, lowBound = 0)

# dictionary of absolute deviations of portfolio returns

y = pulp.LpVariable.dicts('y', t.values(), lowBound = 0)

z = pulp.LpVariable.dicts('z', t.values(), lowBound = 0)

# create problem instance

lp = pulp.LpProblem('MAD Portfolio',pulp.LpMinimize)

# add objective

lp += m

# calculate mean absolute deviation of portfolio returns

lp += m == pulp.lpSum([(y[k] + z[k]) for k in t.values()])/float(len(t))

# relate the absolute deviations to deviations in the portfolio returns

for ts in returns.index:

lp += y[t[ts]] - z[t[ts]] == pulp.lpSum([w[s]*(returns[s][ts]-returns[s].mean()) for s in portfolio])

# portfolio weights

lp += pulp.lpSum([w[s] for s in portfolio]) == 1.0

# bound on average portfolio return

lp += pulp.lpSum([w[s]*(returns[s].mean()) for s in portfolio]) >= 0*R_equal.mean()

lp.solve()

print pulp.LpStatus[lp.status]

Optimal

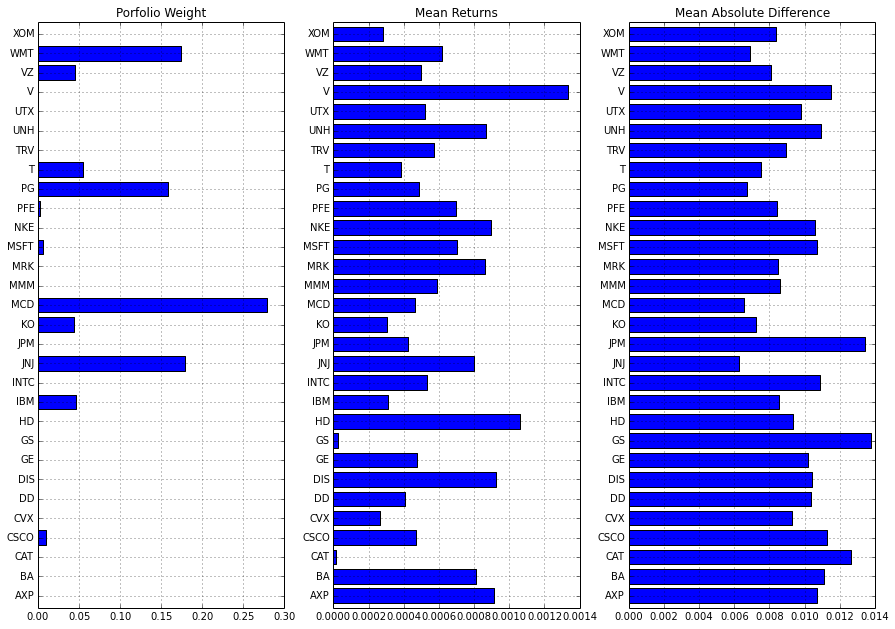

figure(figsize = (15,0.35*len(returns.columns)))

ws = pd.Series({s: w[s].varValue for s in portfolio},index=portfolio)

subplot(1,3,1)

ws.plot(kind='barh')

title('Porfolio Weight');

subplot(1,3,2)

returns.mean().plot(kind='barh')

title('Mean Returns');

subplot(1,3,3)

abs(returns-returns.mean()).mean().plot(kind='barh')

title('Mean Absolute Difference');

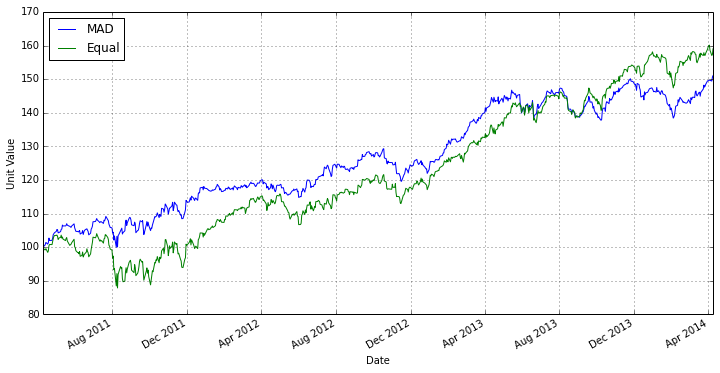

P_mad = pd.Series(0,index=adjclose.index)

for s in portfolio:

P_mad += 100.0*ws[s]*adjclose[s]/adjclose[s][0]

figure(figsize=(12,6))

P_mad.plot()

P_equal.plot()

legend(['MAD','Equal'],loc='best')

ylabel('Unit Value')

<matplotlib.text.Text at 0x10e0bed90>

figure(figsize=(10,6))

for s in portfolio:

plot(mad[s],rmean[s],'s')

text(mad[s]*1.03,rmean[s],s)

axis([0, 1.1*max(mad), min([0,min(rmean)-.1*(max(rmean)-min(rmean))]), 1.1*max(rmean)])

ax = axis()

plot([ax[0],ax[1]],[0,0],'r--');

#R_equal = P_equal.diff()[1:]/P_equal[1:]

R_equal = log(P_equal/P_equal.shift(+1))

M_equal = abs(R_equal-R_equal.mean()).mean()

plot(M_equal,R_equal.mean(),'ro',ms=15)

#R_mad = P_mad.diff()[1:]/P_mad[1:]

R_mad = log(P_mad/P_mad.shift(+1))

M_mad = abs(R_mad-R_mad.mean()).mean()

for s in portfolio:

if ws[s] >= 0.0001:

plot([M_mad,mad[s]],[R_mad.mean(),rmean[s]],'g--')

plot(M_mad,R_mad.mean(),'go',ms=15)

title('Risk/Return for an Equally Weighted Portfolio')

xlabel('Mean Absolute Deviation')

ylabel('Mean Return')

grid();

Problem 1: Solve for Dominating MAD Portfolio#

lp = pulp.LpProblem('MAD Portfolio',pulp.LpMinimize)

lp += m

lp += m == pulp.lpSum([(y[t] + z[t])/float(len(returns.index)) for t in tmap.values()])

lp += pulp.lpSum([w[s] for s in symbols]) == 1.0

for t in returns.index:

lp += y[tsec[t]] - z[tsec[t]] == pulp.lpSum([w[s]*(returns[s][t]-rmean[s]) for s in symbols])

lp.solve()

m_min = m.varValue

m_min

---------------------------------------------------------------------------

NameError Traceback (most recent call last)

<ipython-input-94-7e6a74985eb9> in <module>()

1 lp = pulp.LpProblem('MAD Portfolio',pulp.LpMinimize)

2 lp += m

----> 3 lp += m == pulp.lpSum([(y[t] + z[t])/float(len(returns.index)) for t in tmap.values()])

4 lp += pulp.lpSum([w[s] for s in symbols]) == 1.0

5

NameError: name 'tmap' is not defined

# Solve for maximum return at minimum MAD

r = pulp.LpVariable('r',lowBound = 0)

lp = pulp.LpProblem('MAD Portfolio',pulp.LpMaximize)

lp += r

lp += r == pulp.lpSum([w[s]*rmean[s] for s in symbols])

lp += m_min == pulp.lpSum([(y[t] + z[t])/float(len(returns.index)) for t in tmap.values()])

lp += pulp.lpSum([w[s] for s in symbols]) == 1.0

for t in returns.index:

lp += y[tsec[t]] - z[tsec[t]] == pulp.lpSum([w[s]*(returns[s][t]-rmean[s]) for s in symbols])

lp.solve()

r_min = r.varValue

w_min = pd.Series([pulp.value(w[s]) for s in symbols], index= symbols)

---------------------------------------------------------------------------

NameError Traceback (most recent call last)

<ipython-input-95-bb19d9078a1c> in <module>()

5 lp = pulp.LpProblem('MAD Portfolio',pulp.LpMaximize)

6 lp += r

----> 7 lp += r == pulp.lpSum([w[s]*rmean[s] for s in symbols])

8 lp += m_min == pulp.lpSum([(y[t] + z[t])/float(len(returns.index)) for t in tmap.values()])

9 lp += pulp.lpSum([w[s] for s in symbols]) == 1.0

NameError: name 'symbols' is not defined