Log-Optimal Portfolios

Contents

Log-Optimal Portfolios#

This notebook demonstrates the Kelly criterion and other phenomena associated with log-optimal growth.

Initializations#

import matplotlib.pyplot as plt

import numpy as np

import random

Kelly’s Criterion#

In a nutshell, Kelly’s criterion is to choose strategies that maximize expected log return.

where \(R\) is total return. As we learned, Kelly’s criterion has properties useful in the context of long-term investments.

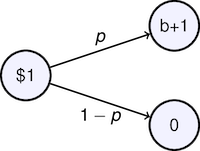

Example 1. Maximizing Return for a Game with Arbitrary Odds#

Consider a game with two outcomes. For each \\(1 wagered, a successful outcome with probability \)p\( returns \)b+1\( dollars. An unsuccessful outcome returns nothing. What fraction \)w$ of our portfolio should we wager on each turn of the game?

There are two outcomes with returns

The expected log return becomes

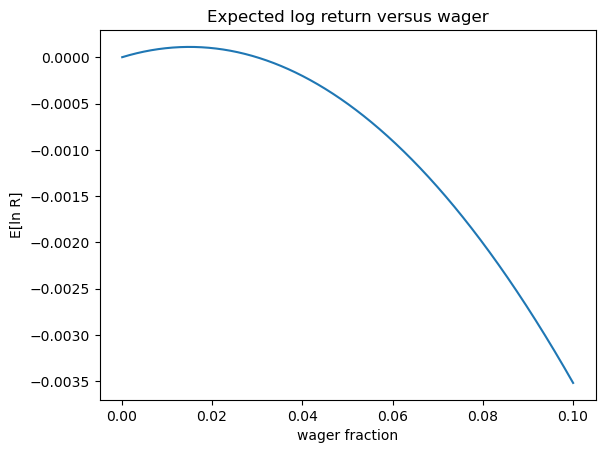

p = 0.5075

b = 1

w = np.linspace(0.0001, 0.1, 1000)

plt.plot(w, p*np.log(1 + w*b) + (1 - p)*np.log(1 - w))

plt.xlabel("wager fraction")

plt.ylabel("E[ln R]")

plt.title("Expected log return versus wager")

Text(0.5, 1.0, 'Expected log return versus wager')

Applying Kelly’s criterion, we seek a value for \(w\) that maximizes \(E[\ln R]\). Taking derivatives

Solving for \(w\)

The growth rate is then the value of \(E[\ln R]\) when \(w = w_{opt}\), i.e.,

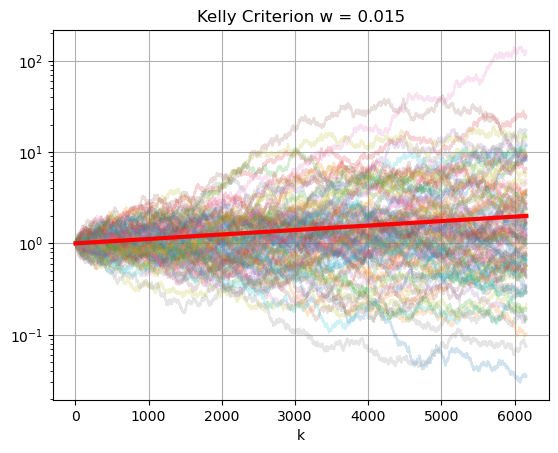

You can test how well this works in the following cell. Fix \(p\) and \(b\), and let the code do a Monte Carlo simulation to show how well Kelly’s criterion works.

import numpy as np

from numpy.random import uniform

p = 0.5075

b = 1

# Kelly criterion

w = (p*(b + 1) - 1)/b

# optimal growth rate

m = p*np.log(1 + w*b) + (1-p)*np.log(1 - w)

# number of plays to double wealth

K = int(np.log(2)/m)

# monte carlo simulation and plotting

for n in range(0, 100):

W = [1]

for k in range(0,K):

if uniform() <= p:

W.append(W[-1]*(1 + w*b))

else:

W.append(W[-1]*(1 - w))

plt.semilogy(W, alpha=0.2)

plt.semilogy(np.linspace(0,K), np.exp(m*np.linspace(0,K)), 'r', lw=3)

plt.title(f'Kelly Criterion w = {w:0.3f}')

plt.xlabel('k')

plt.grid()

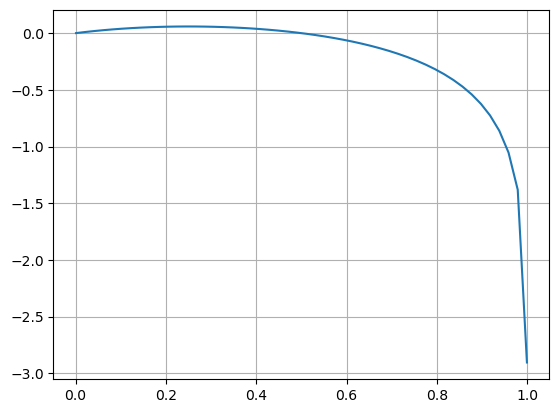

Example 2. Multiple Outcomes#

import numpy as np

import matplotlib.pyplot as plt

w1 = np.linspace(0.001, 0.999)

w2 = 0

w3 = 0

p1 = 1/2

p2 = 1/3

p3 = 1/6

R1 = 1 + 2*w1 - w2 - w3

R2 = 1 - w1 + w2 - w3

R3 = 1 - w1 - w2 + 5*w3

m = p1*np.log(R1) + p2*np.log(R2) + p3*np.log(R3)

plt.plot(w1,m)

plt.grid()

def wheel(w,N = 100):

w1, w2, w3 = w

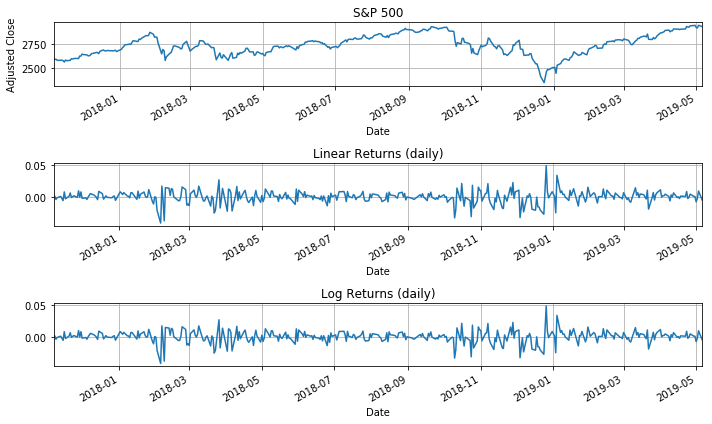

Example 3. Stock/Bond Portfolio in Continuous Time#

%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import datetime

from pandas_datareader import data, wb

from scipy.stats import norm

import requests

def get_symbol(symbol):

"""

get_symbol(symbol) uses Yahoo to look up a stock trading symbol and

return a description.

"""

url = "http://d.yimg.com/autoc.finance.yahoo.com/autoc?query={}®ion=1&lang=en".format(symbol)

result = requests.get(url).json()

for x in result['ResultSet']['Result']:

if x['symbol'] == symbol:

return x['name']

symbol = '^GSPC'

# end date is today

end = datetime.datetime.today().date()

# start date is three years prior

start = end-datetime.timedelta(1.5*365)

# get stock price data

S = data.DataReader(symbol,"yahoo",start,end)['Adj Close']

rlin = (S - S.shift(1))/S.shift(1)

rlog = np.log(S/S.shift(1))

rlin = rlin.dropna()

rlog = rlog.dropna()

# plot data

plt.figure(figsize=(10,6))

plt.subplot(3,1,1)

S.plot(title=get_symbol(symbol))

plt.ylabel('Adjusted Close')

plt.grid()

plt.subplot(3,1,2)

rlin.plot()

plt.title('Linear Returns (daily)')

plt.grid()

plt.tight_layout()

plt.subplot(3,1,3)

rlog.plot()

plt.title('Log Returns (daily)')

plt.grid()

plt.tight_layout()

print('Linear Returns')

mu,sigma = norm.fit(rlin)

print(' mu = {0:12.8f} (annualized = {1:.2f}%)'.format(mu,100*252*mu))

print('sigma = {0:12.8f} (annualized = {1:.2f}%)'.format(sigma,100*np.sqrt(252)*sigma))

print()

print('Log Returns')

nu,sigma = norm.fit(rlog)

print(' nu = {0:12.8f} (annualized = {1:.2f}%)'.format(nu,100*252*nu))

print('sigma = {0:12.8f} (annualized = {1:.2f}%)'.format(sigma,100*np.sqrt(252)*sigma))

Linear Returns

mu = 0.00037731 (annualized = 9.51%)

sigma = 0.00961646 (annualized = 15.27%)

Log Returns

nu = 0.00033089 (annualized = 8.34%)

sigma = 0.00963609 (annualized = 15.30%)

mu = 252*mu

nu = 252*nu

sigma = np.sqrt(252)*sigma

rf = 0.04

mu = 0.08

sigma = 0.3

w = (mu-rf)/sigma**2

nu_opt = rf + (mu-rf)**2/2/sigma/sigma

sigma_opt = np.sqrt(mu-rf)/sigma

print(w,nu_opt,sigma_opt)

0.4444444444444445 0.04888888888888889 0.6666666666666667

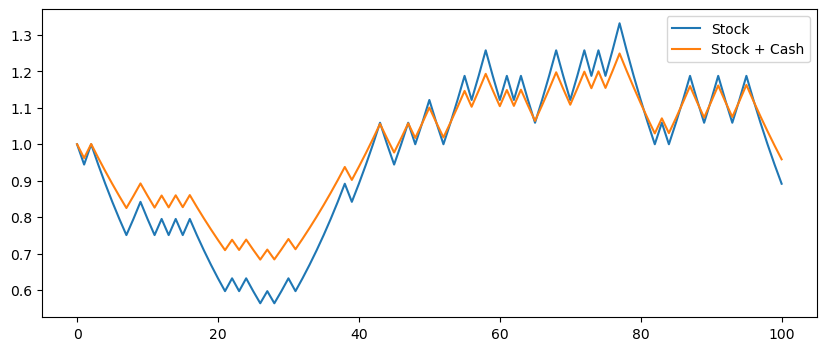

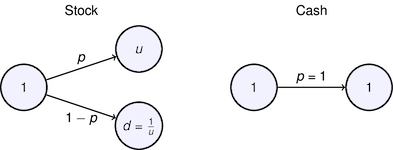

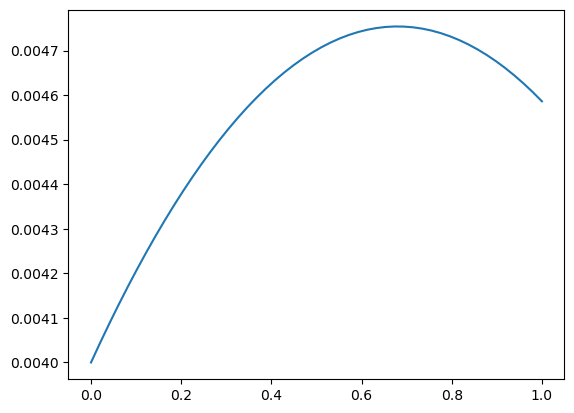

Volatility Pumping#

# payoffs for two states

u = 1.059

d = 1/u

p = 0.54

rf = 0.004

K = 100

ElnR = p*np.log(u) + (1-p)*np.log(d)

print("Expected return = {:0.5}".format(ElnR))

Z = np.array([float(random.random() <= p) for _ in range(0,K)])

R = d + (u-d)*Z

S = np.cumprod(np.concatenate(([1],R)))

ElnR = lambda alpha: p*np.log(alpha*u +(1-alpha)*np.exp(rf)) + \

(1-p)*np.log(alpha*d + (1-alpha)*np.exp(rf))

a = np.linspace(0,1)

plt.plot(a, list(map(ElnR, a)))

Expected return = 0.004586

[<matplotlib.lines.Line2D at 0x7fad84ce3d00>]

from scipy.optimize import fminbound

alpha = fminbound(lambda alpha: -ElnR(alpha), 0, 1)

print(alpha)

#plt.plot(alpha, ElnR(alpha),'r.',ms=10)

R = alpha*d + (1-alpha) + alpha*(u-d)*Z

S2 = np.cumprod(np.concatenate(([1],R)))

plt.figure(figsize=(10,4))

plt.plot(range(0,K+1),S,range(0,K+1),S2)

plt.legend(['Stock','Stock + Cash']);

0.6799130096484951