Log-Optimal Growth and the Kelly Criterion

Contents

Log-Optimal Growth and the Kelly Criterion#

This IPython notebook demonstrates the Kelly criterion and other phenomena associated with log-optimal growth.

Initializations#

import matplotlib.pyplot as plt

import numpy as np

import random

What are the Issues in Managing for Optimal Growth?#

Suppose we start with an amount of capital, \(W_0\), and wish to grow that amount through a series of business decisions. Let \(R_k\) be the gross return at stage \(k\).

Starting with a wealth \(W_0\), after \(k\) stages our wealth will be

If we could be confident that \(R_k > 1\) for all \(k\), then our wealth will grow over time. But a guaranteed return is rarely available, so we consider cases where there may be some risk.

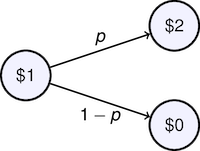

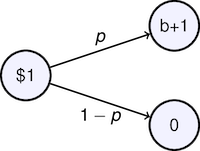

To fix ideas, consider an on-going ‘investment opportunity’ where an invested dollar will yield two dollars with probability \(p\) or nothing with probability \(1-p\). You can think of this as a gambling game if you like, or as sequence of business investment decisions.

Now let’s consider a specific investment strategy. To avoid risking total loss of wealth in a single stage, we invest a fraction \(\alpha\) of our remaining wealth at each stage. If the payoff “wins”, then we get \(2 \alpha W_k\) back. When added to the \((1-\alpha)W_k\) we didn’t invest our wealth is now \((1+\alpha)W_k\). If we lose then our remaining wealth is \((1-\alpha)W_k\).

Under this strategy, the return \(R_k\) is given by

How should we pick \(\alpha\)? A small value means that wealth will grow slowly. A large value will risk more of our wealth in each trial.

Why Maximizing Expected Wealth is a Bad Idea#

At first glance, maximizing expected wealth seems like a reasonable investment objective. Suppose after \(k\) stages we have witnessed \(u\) profitable outcomes (i.e., ‘wins’), and \(k-u\) outcomes showing a loss. The remaining wealth will be given by

The binomial distribution gives the probability of observing \(u\) ‘wins’ in \(k\) trials

So the expected value of \(W_k\) is given by

Next we plot \(E[W_k/W_0]\) as a function of \(\alpha\). If you run this notebook on your own server, you can adjust \(p\) and \(K\) to see the impact of changing parameters.

from scipy.special import comb

from ipywidgets import interact

def sim(K=40, p=0.55):

alpha = np.linspace(0, 1, 100)

W = [sum([comb(K,u)*((p*(1+a))**u)*(((1-p)*(1-a))**(K-u)) \

for u in range(0,K+1)]) for a in alpha]

plt.figure()

plt.plot(alpha, W, 'b')

plt.xlabel('alpha')

plt.ylabel(f'E[W({K:d})/W(0)]')

plt.title(f'Expected Wealth after {K:d} trials')

interact(sim, K=(1, 60), p=(0.4, 0.6, 0.01));

This simulation suggests that if each stage is, on average, a winning proposition with \(p > 0.5\), then expected wealth after \(K\) stages is maximized by setting \(\alpha = 1\).

This turns out to be a very risky strategy. To show how risky, the following cell simulates the behavior of this process for as a function of \(\alpha\), \(p\), and \(K\). Try different values of \(\alpha\) in the range from 0 to 1 to see what happens.

# Number of simulations to run

N = 200

def sim2(K = 50, p = 0.55, alpha = 0.8):

plt.figure()

plt.xlabel('Stage k')

plt.ylabel('Fraction of Initial Wealth');

plt.xlim(0,K)

for n in range(0,N):

# Compute an array of future returns

R = np.array([1-alpha + 2*alpha*float(random.random() <= p) for _ in range(0,K)])

# Use returns to compute fraction of wealth that remains

W = np.concatenate(([1.0],np.cumprod(R)))

plt.semilogy(W)

interact(sim2, K = (10, 60), p = (0.4, 0.6, 0.001), alpha = (0.0, 1.0, 0.01))

<function __main__.sim2(K=50, p=0.55, alpha=0.8)>

Attempting to maximize wealth leads to a risky strategy where all wealth is put at risk at each stage hoping for a string of \(k\) wins. The very high rewards for this one outcome mask the fact that the most common outcome is to lose everything. If you’re not convinced of this, go back and run the simulation a few more times for values of alpha in the range 0.8 to 1.0.

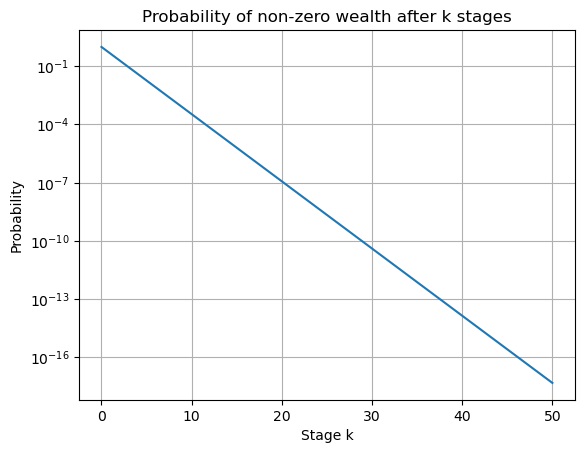

If \(\alpha =1\), the probability of still having money after \(k\) stages is \((1-p)^k\).

K = 50

p = 0.55

plt.semilogy(range(0,K+1), [(1-p)**k for k in range(0,K+1)])

plt.title('Probability of non-zero wealth after k stages')

plt.xlabel('Stage k')

plt.ylabel('Probability')

plt.grid();

The problem with maximizing expected wealth is that the objective ignores the associated financial risks. For the type of application being analyzed here, the possibility of a few very large outcomes are averaged with many others showing loss. While the average outcome make look fine, the most likely outcome is a very different result.

It’s like the case of buying into a high stakes lottery. The average outcome is calculated by including the rare outcome of the winning ticket together millions of tickets where there is no payout whatsoever. Buying lottery tickets shouldn’t be anyone’s notion of a good business plan!

from scipy.special import comb

from scipy.stats import binom

from ipywidgets import interact

K = 40

def Wpdf(p=0.55, alpha=0.5):

rv = binom(K, p)

U = np.array(range(0, K+1))

Pr = np.array([rv.pmf(u) for u in U])

W = np.array([((1 + alpha)**u)*(((1 - alpha))**(K-u)) for u in U])

plt.figure(figsize=(12, 4))

plt.subplot(2, 2, 1)

plt.bar(U - 0.5, W)

plt.xlim(-0.5, K+0.5)

plt.ylabel('W(u)/W(0)')

plt.xlabel('u')

plt.title('Final Return W(K={0})/W(0) vs. u for alpha = {1:.3f}'.format(K,alpha))

plt.subplot(2,2,3)

plt.bar(U-0.5,Pr)

plt.xlim(-0.5,K+0.5)

plt.ylabel('Prob(u)')

plt.xlabel('u')

plt.title('Binomial Distribution K = {0}, p = {1:.3f}'.format(K,p))

plt.subplot(1,2,2)

plt.semilogx(W,Pr,'b')

plt.xlabel('W(K={0})/W(0)'.format(K))

plt.ylabel('Prob(W(K={0})/W(0)'.format(K))

plt.title('Distribution for Total Return W(K={0})/W(0)'.format(K))

plt.ylim([0,0.2])

Wbar = sum(Pr*W)

#WVaR = W[rv.ppf(0.05)]

#Wmed = 0.5*(W[rv.ppf(0.49)] + W[rv.ppf(0.51)])

ylim = np.array(plt.ylim())

#plt.plot([WVaR,WVaR],0.5*ylim,'r--')

plt.plot([Wbar,Wbar],0.5*ylim,'b--')

plt.text(Wbar,0.5*ylim[1],' Average = {0:.3f}'.format(Wbar))

#plt.text(Wmed,0.75*ylim[1],' Median = {0:.3f}'.format(Wmed))

#plt.text(WVaR,0.5*ylim[1],'5th Percentile = {0:.3f}'.format(WVaR),ha='right')

#plt.plot([Wmed,Wmed],ylim,'r',lw=2)

plt.tight_layout()

interact(Wpdf, p = (0.4,0.6,0.01), alpha = (0.01,0.99,0.01))

<function __main__.Wpdf(p=0.55, alpha=0.5)>

Exercise#

Imagine you’re playing a game of chance in which you expect to win 60% of the time. You expect to play 40 rounds in the game. The initial capital required to enter the game is high enough that losing half of your capital is something you could tolerate only 5% of the time. What fraction of your capital would you be willing to wager on each play of the game?

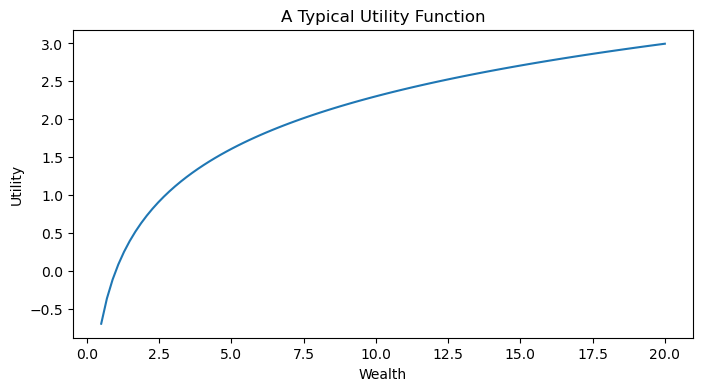

Utility Functions#

A utility function measures the ‘utility’ of holding some measure of wealth. The key concept is that the marginal utility of wealth decreases as wealth increases. If you don’t have much money, then finding USD 20 on the sidewalk may have considerable utility since it may mean that you don’t have to walk home from work. On the other hand, if you’re already quite wealthy, the incremental utility of a USD 20 may not be as high.

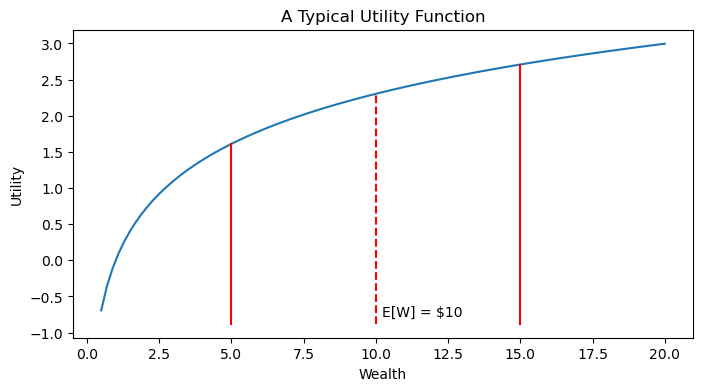

A typical utility function is shown on the following chart.

def U(x):

return np.log(x)

def plotUtility(U):

plt.figure(figsize=(8, 4))

x = np.linspace(0.5, 20.0, 100)

plt.plot(x, U(x))

plt.xlabel('Wealth')

plt.ylabel('Utility')

plt.title('A Typical Utility Function');

plotUtility(U)

To see how utilty functions allow us to incorporate risk into an objective function, consider the expected utility of a bet on a single flip of a coin. The bet pays USD 5 if the coin comes up ‘Heads’, and USD 15 if the coin comes up Tails. For a fair coin, the expected wealth is therefore

which is shown on the chart with the utility function.

plotUtility(U)

ymin,ymax = plt.ylim()

plt.plot([5, 5], [ymin, U(5)], 'r')

plt.plot([15, 15], [ymin, U(15)], 'r')

plt.plot([10, 10], [ymin, U(10)], 'r--')

plt.text(10.2, ymin+0.1, 'E[W] = \$10');

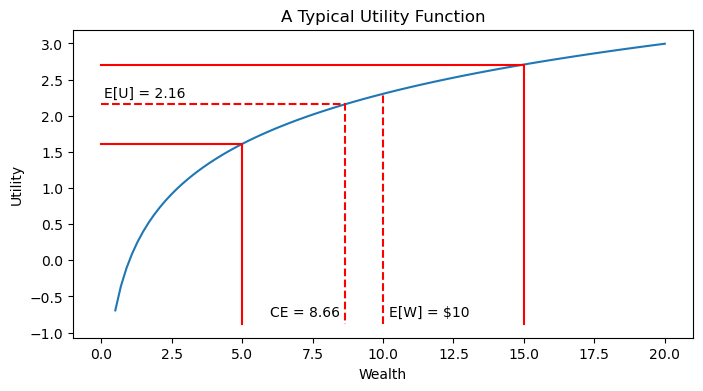

Finding the expected utility, we can use the utilty function to solve for the ‘certainty equivalent’ value of the game. The certainty equivalent value is the amount of wealth that has the same utility as the expected utility of the game.

Because the utilty function is concave, the certainty equivalent value is less than the expected value of the game. The difference between the two values is the degree to which we discount the value of the game due to it’s uncertain nature.

from scipy.optimize import brentq

plotUtility(U)

ymin,ymax = plt.ylim()

plt.plot([5,5,0],[ymin,U(5),U(5)],'r')

plt.plot([15,15,0],[ymin,U(15),U(15)],'r')

plt.plot([10,10],[ymin,U(10)],'r--')

plt.text(10.2,ymin+0.1,'E[W] = \$10');

Uave = 0.5*(U(5)+U(15))

Ceq = brentq(lambda x: U(x)-Uave,5,15)

plt.plot([0,Ceq,Ceq],[Uave,Uave,ymin],'r--')

plt.text(0.1,Uave+0.1,'E[U] = {:.2f}'.format(Uave))

plt.text(Ceq-0.2,ymin+0.1,'CE = {:.2f}'.format(Ceq),ha='right');

Maximizing Growth#

To acheive a different result we need to consider optimization objective that incorporates a measure of risk. For example, the log ratio of current to starting wealth gives a relationship

Subjectively, the log ratio focuses relative rather than absolute growth which, for many investors, is a better indicator of investment objectives. Rather than risk all for an enormous but unlikely outcome, a strategy optimizing expected relative growth will tradeoff risky strategies for more robust strategies demonstrating relative growth.

Taking expectations

where

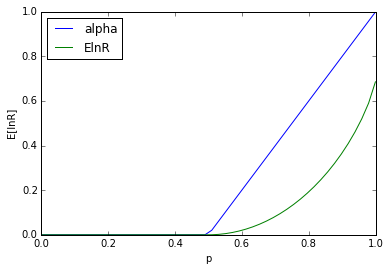

With simple calculus we can show that maximizing \(E[\ln W_K/W_0]\) requires

which yields a growth rate per stage

p = np.linspace(0.001,0.999)

alpha = np.array([max(0,2.0*q-1.0) for q in p])

plt.plot(p,alpha)

m = np.multiply(p,np.log(1.0+alpha)) + np.multiply(1.0-p,np.log(1.0-alpha))

plt.plot(p,m)

plt.xlabel('p')

plt.ylabel('E[lnR]')

plt.legend(['alpha','ElnR'],loc='upper left')

<matplotlib.legend.Legend at 0x109f43a50>

import numpy as np

np.exp((1/6)*(np.log(4000000) + np.log(1000000) + np.log(25000)+np.log(10000) + np.log(300) + np.log(5)))

10699.131939336632

Kelly’s Criterion: Maximizing Growth for a Game with Arbitrary Odds#

Solving for \(\alpha\)

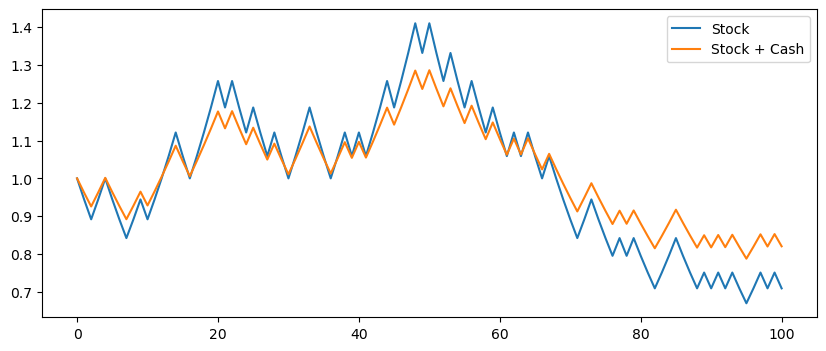

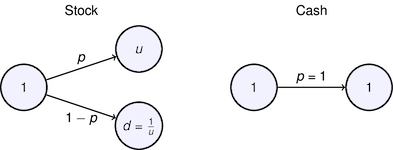

Volatility Pumping#

# payoffs for two states

u = 1.059

d = 1/u

p = 0.54

rf = 0.004

K = 100

ElnR = p*np.log(u) + (1-p)*np.log(d)

print("Expected return = {:0.5}".format(ElnR))

Z = np.array([float(random.random() <= p) for _ in range(0,K)])

R = d + (u-d)*Z

S = np.cumprod(np.concatenate(([1],R)))

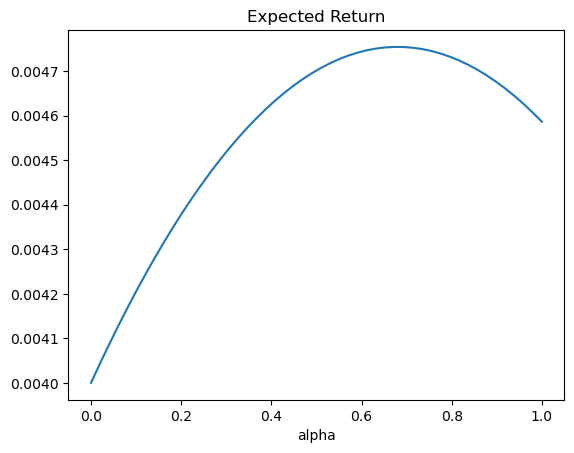

ElnR = lambda alpha: p*np.log(alpha*u +(1-alpha)*np.exp(rf)) + \

(1-p)*np.log(alpha*d + (1-alpha)*np.exp(rf))

a = np.linspace(0,1)

plt.plot(a, list(map(ElnR, a)))

plt.title("Expected Return")

plt.xlabel("alpha")

Expected return = 0.004586

Text(0.5, 0, 'alpha')

from scipy.optimize import fminbound

alpha = fminbound(lambda alpha: -ElnR(alpha), 0, 1)

print(alpha)

#plt.plot(alpha, ElnR(alpha),'r.',ms=10)

R = alpha*d + (1-alpha) + alpha*(u-d)*Z

S2 = np.cumprod(np.concatenate(([1],R)))

plt.figure(figsize=(10,4))

plt.plot(range(0,K+1),S,range(0,K+1),S2)

plt.legend(['Stock','Stock + Cash']);

0.6799130096484951