2.7. Non-Continuous Objectives#

Keywords: linear programming, cbc usage, production models

This notebook demonstrates the use of linear programming to maximize profit for a simple model of a multiproduct production facility. The notebook uses Pyomo to represent the model with the COINOR-CBC solver to calculate solutions.

2.7.1. Imports#

%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

import shutil

import sys

import os.path

if not shutil.which("pyomo"):

!pip install -q pyomo

assert(shutil.which("pyomo"))

if not (shutil.which("cbc") or os.path.isfile("cbc")):

if "google.colab" in sys.modules:

!apt-get install -y -qq coinor-cbc

else:

try:

!conda install -c conda-forge coincbc

except:

pass

assert(shutil.which("cbc") or os.path.isfile("cbc"))

from pyomo.environ import *

2.7.2. Example: Production Bonuses#

A plant produces three products in the amounts \(x\), \(y\), and \(z\) with unit profit of \\(40, \\\)30, and \$50, respectively. There are several constraints imposed by product demand and the availability of specialized labor

In addition, the plant receives bonuses for meeting certain production targets

If the plant produces more than 20 \(y\) items, then the unit profit for \(y\) will be \\(50 plus a fixed bonus of \\\)200.

If the plant produces more than 30 \(z\) items, then the unit profit for \(z\) will be \\(60 plus a fixed bonus of \\\)300.

Find the optimal production targets.

2.7.3. Model 1. Without bonuses#

from pyomo.environ import *

model = ConcreteModel()

model.x = Var(domain=NonNegativeReals)

model.y = Var(domain=NonNegativeReals)

model.z = Var(domain=NonNegativeReals)

model.profit = Objective(expr = 40*model.x + 30*model.y + 50*model.z, sense=maximize)

model.demand = Constraint(expr = model.x <= 40)

model.laborA = Constraint(expr = model.x + model.y <= 80)

model.laborB = Constraint(expr = 2*model.x + model.z <= 100)

model.laborC = Constraint(expr = model.z <= 50)

# solve

SolverFactory('cbc').solve(model).write()

# ==========================================================

# = Solver Results =

# ==========================================================

# ----------------------------------------------------------

# Problem Information

# ----------------------------------------------------------

Problem:

- Name: unknown

Lower bound: -5150.0

Upper bound: -5150.0

Number of objectives: 1

Number of constraints: 5

Number of variables: 4

Number of nonzeros: 2

Sense: maximize

# ----------------------------------------------------------

# Solver Information

# ----------------------------------------------------------

Solver:

- Status: ok

User time: -1.0

System time: 0.0

Wallclock time: 0.0

Termination condition: optimal

Termination message: Model was solved to optimality (subject to tolerances), and an optimal solution is available.

Statistics:

Branch and bound:

Number of bounded subproblems: None

Number of created subproblems: None

Black box:

Number of iterations: 1

Error rc: 0

Time: 0.02187371253967285

# ----------------------------------------------------------

# Solution Information

# ----------------------------------------------------------

Solution:

- number of solutions: 0

number of solutions displayed: 0

The results of the solution step show the solver has converged to an optimal solution. Next we display the particular components of the model of interest to us.

print(f"Profit = ${model.profit()}")

print(f"X = {model.x()} units")

print(f"Y = {model.y()} units")

print(f"Z = {model.z()} units")

Profit = $5150.0

X = 25.0 units

Y = 55.0 units

Z = 50.0 units

2.7.4. Model 2. Include bonuses#

To incorporate the bonus structure into the objective function, we introduce new decision variables

where \(y\) and \(z\) denote total production, and \(y_1\) and \(z_1\) denote production above bonus levels. In addition, we introduce two binary variables, \(b_y\) and \(b_z\), to indicate when \(y\) or \(z\), respectively, are in a bonus condition.

The profit objective becomes (after some arithmetic)

For a sufficiently large value of \(M\), the constraints

enforce the bonus conditions.

Let’s verify this formulation and new objective before proceeding further.

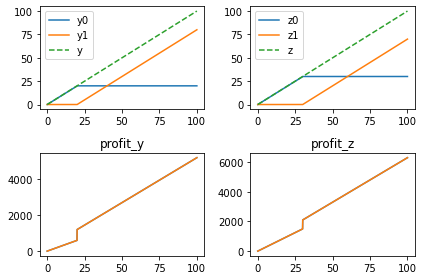

y = np.linspace(0, 100, 1000)

profit_y = [30*_ if _ <= 20 else (50*_ + 200) for _ in y]

y0 = np.array([min(20, _) for _ in y])

y1 = y - y0

by = np.array([1 if _ > 0 else 0 for _ in y1])

bonus_y = 30*y0 + 50*y1 + 600*by

fig, ax = plt.subplots(2, 2)

ax[0,0].plot(y, y0, label='y0')

ax[0,0].plot(y, y1, label='y1')

ax[0,0].plot(y, y0 + y1, '--', label='y')

ax[0,0].legend()

ax[1,0].plot(y, profit_y)

ax[1,0].plot(y, bonus_y)

ax[1,0].set_title("profit_y")

z = np.linspace(0, 100, 1000)

profit_z = [50*_ if _ <= 30 else (60*_ + 300) for _ in z]

z0 = np.array([min(30, _) for _ in z])

z1 = z - z0

bz = np.array([1 if _ > 0 else 0 for _ in z1])

bonus_z = 50*z0 + 60*z1 + 600*bz

ax[0,1].plot(z, z0, label='z0')

ax[0,1].plot(z, z1, label='z1')

ax[0,1].plot(z, z0 + z1, '--', label='z')

ax[0,1].legend()

ax[1,1].plot(y, profit_z)

ax[1,1].plot(y, bonus_z)

ax[1,1].set_title("profit_z")

fig.tight_layout()

The corresponding Pyomo model follows. Note that this could be streamlined in various ways.

from pyomo.environ import *

M = 100

model = ConcreteModel()

model.x = Var(domain=NonNegativeReals)

model.y = Var(domain=NonNegativeReals)

model.y0 = Var(bounds=(0, 20))

model.y1 = Var(domain=NonNegativeReals)

model.by = Var(domain=Binary)

model.z = Var(domain=NonNegativeReals)

model.z0 = Var(bounds=(0, 30))

model.z1 = Var(domain=NonNegativeReals)

model.bz = Var(domain=Binary)

model.profit = Objective(sense=maximize, expr =

+ 40*model.x \

+ 30*model.y0 + 50*model.y1 + 600*model.by \

+ 50*model.z0 + 60*model.z1 + 600*model.bz)

model.dy = Constraint(expr = model.y == model.y0 + model.y1)

model.dz = Constraint(expr = model.z == model.z0 + model.z1)

model.demand = Constraint(expr = model.x <= 40)

model.laborA = Constraint(expr = model.x + model.y <= 80)

model.laborB = Constraint(expr = 2*model.x + model.z <= 100)

model.laborC = Constraint(expr = model.z <= 50)

model.bonus_y0 = Constraint(expr = model.y0 >= 20 - M*(1 - model.by))

model.bonus_z0 = Constraint(expr = model.z0 >= 30 - M*(1 - model.bz))

model.bonus_y1 = Constraint(expr = model.y1 <= M*model.by)

model.bonus_z1 = Constraint(expr = model.z1 <= M*model.bz)

# solve

SolverFactory('cbc').solve(model).write()

# ==========================================================

# = Solver Results =

# ==========================================================

# ----------------------------------------------------------

# Problem Information

# ----------------------------------------------------------

Problem:

- Name: unknown

Lower bound: -7500.0

Upper bound: -7500.0

Number of objectives: 1

Number of constraints: 7

Number of variables: 8

Number of binary variables: 2

Number of integer variables: 2

Number of nonzeros: 7

Sense: maximize

# ----------------------------------------------------------

# Solver Information

# ----------------------------------------------------------

Solver:

- Status: ok

User time: -1.0

System time: 0.05

Wallclock time: 0.06

Termination condition: optimal

Termination message: Model was solved to optimality (subject to tolerances), and an optimal solution is available.

Statistics:

Branch and bound:

Number of bounded subproblems: 0

Number of created subproblems: 0

Black box:

Number of iterations: 0

Error rc: 0

Time: 0.08483672142028809

# ----------------------------------------------------------

# Solution Information

# ----------------------------------------------------------

Solution:

- number of solutions: 0

number of solutions displayed: 0

print(f"Profit = ${model.profit()}")

print(f"X = {model.x()} units")

print(f"Y = {model.y0()} + {model.y1()} = {model.y()} units {model.by()}")

print(f"Z = {model.z0()} + {model.z1()} = {model.z()} units {model.bz()}")

Profit = $7500.0

X = 0.0 units

Y = 20.0 + 60.0 = 80.0 units 1.0

Z = 30.0 + 20.0 = 50.0 units 1.0

2.7.6. Exercise#

Reformulate this model using the Pyomo.GDP package. Parameterize values for the profit objective, bonus amounts, and bonus levels.

2.7.5. Comments#

This particular formulation leaves much to be desired.

The main thing is a lack of numerical robustness on the constraints for \(z_0\) and \(y_0\). * * It would also be useful to parameterize and general the bonus structure.

The big M method often yields redundant constraints and numerical performance that depends on the choice of M. Generalized disjunctive constraints provide more solution options.